All Categories

Featured

Table of Contents

This five-year general policy and 2 adhering to exceptions apply only when the owner's fatality triggers the payout. Annuitant-driven payouts are reviewed listed below. The initial exemption to the basic five-year guideline for private recipients is to accept the death advantage over a longer duration, not to go beyond the expected life time of the beneficiary.

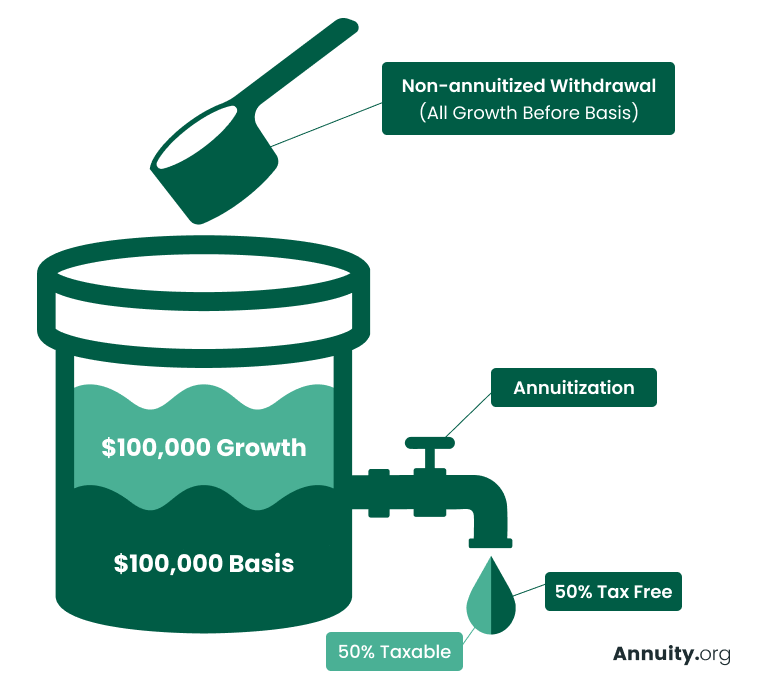

If the beneficiary chooses to take the survivor benefit in this technique, the benefits are exhausted like any type of other annuity payments: partly as tax-free return of principal and partly taxable revenue. The exclusion ratio is located by utilizing the departed contractholder's price basis and the expected payments based on the recipient's life span (of shorter period, if that is what the recipient picks).

In this method, in some cases called a "stretch annuity", the recipient takes a withdrawal annually-- the called for quantity of each year's withdrawal is based on the exact same tables utilized to calculate the required distributions from an individual retirement account. There are 2 benefits to this technique. One, the account is not annuitized so the recipient retains control over the cash money worth in the agreement.

The 2nd exception to the five-year policy is available just to a making it through spouse. If the marked recipient is the contractholder's partner, the partner might elect to "enter the footwear" of the decedent. Basically, the spouse is dealt with as if he or she were the proprietor of the annuity from its inception.

Are Annuity Payouts taxable when inherited

Please note this applies only if the spouse is named as a "designated recipient"; it is not readily available, for instance, if a count on is the beneficiary and the partner is the trustee. The general five-year policy and both exemptions just apply to owner-driven annuities, not annuitant-driven agreements. Annuitant-driven contracts will pay survivor benefit when the annuitant dies.

For functions of this discussion, assume that the annuitant and the owner are various - Long-term annuities. If the agreement is annuitant-driven and the annuitant dies, the fatality causes the fatality advantages and the recipient has 60 days to choose how to take the death advantages based on the terms of the annuity agreement

Also note that the option of a partner to "enter the shoes" of the proprietor will not be available-- that exemption uses only when the proprietor has actually died but the proprietor didn't die in the instance, the annuitant did. If the recipient is under age 59, the "fatality" exemption to prevent the 10% penalty will not use to a premature circulation again, because that is readily available only on the fatality of the contractholder (not the fatality of the annuitant).

Lots of annuity companies have inner underwriting policies that reject to issue agreements that call a different owner and annuitant. (There may be strange situations in which an annuitant-driven contract fulfills a clients special needs, however typically the tax obligation drawbacks will certainly outweigh the benefits - Annuity death benefits.) Jointly-owned annuities may pose comparable problems-- or a minimum of they may not serve the estate preparation feature that various other jointly-held possessions do

Therefore, the fatality benefits have to be paid within 5 years of the initial proprietor's death, or based on both exceptions (annuitization or spousal continuance). If an annuity is held jointly between a partner and wife it would certainly appear that if one were to die, the other can just continue possession under the spousal continuation exception.

Assume that the hubby and other half named their boy as beneficiary of their jointly-owned annuity. Upon the fatality of either proprietor, the business needs to pay the death advantages to the kid, that is the beneficiary, not the making it through partner and this would most likely defeat the owner's purposes. Was wishing there may be a device like establishing up a recipient Individual retirement account, yet looks like they is not the situation when the estate is arrangement as a recipient.

That does not recognize the type of account holding the acquired annuity. If the annuity was in an inherited IRA annuity, you as executor must have the ability to designate the inherited individual retirement account annuities out of the estate to inherited Individual retirement accounts for each estate recipient. This transfer is not a taxed event.

Any distributions made from inherited Individual retirement accounts after job are taxable to the beneficiary that received them at their normal income tax obligation rate for the year of circulations. If the inherited annuities were not in an Individual retirement account at her fatality, after that there is no means to do a direct rollover right into an acquired Individual retirement account for either the estate or the estate recipients.

If that happens, you can still pass the circulation through the estate to the private estate beneficiaries. The tax return for the estate (Type 1041) might consist of Type K-1, passing the earnings from the estate to the estate recipients to be strained at their specific tax prices as opposed to the much greater estate revenue tax obligation prices.

Is an inherited Annuity Income Stream taxable

: We will produce a plan that includes the finest items and attributes, such as boosted death benefits, costs bonus offers, and irreversible life insurance.: Obtain a tailored strategy made to maximize your estate's value and reduce tax obligation liabilities.: Implement the selected technique and receive ongoing support.: We will certainly assist you with establishing the annuities and life insurance coverage policies, offering continuous guidance to guarantee the plan continues to be effective.

Must the inheritance be regarded as an income related to a decedent, then taxes may apply. Generally speaking, no. With exemption to pension (such as a 401(k), 403(b), or IRA), life insurance policy profits, and savings bond rate of interest, the beneficiary normally will not have to birth any kind of income tax on their inherited riches.

The amount one can inherit from a trust without paying tax obligations depends on numerous variables. Specific states may have their very own estate tax regulations.

His mission is to simplify retired life planning and insurance, making certain that customers comprehend their selections and secure the very best coverage at irresistible prices. Shawn is the owner of The Annuity Specialist, an independent on the internet insurance coverage agency servicing customers across the USA. With this platform, he and his group objective to remove the uncertainty in retirement planning by assisting individuals discover the most effective insurance policy coverage at the most affordable prices.

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works Defining the Right Financial Strategy Features of Smart Investment Choices Why Tax Benefits Of Fixed Vs Variable

Understanding Tax Benefits Of Fixed Vs Variable Annuities A Comprehensive Guide to Variable Vs Fixed Annuities Defining the Right Financial Strategy Advantages and Disadvantages of Different Retiremen

Analyzing Retirement Income Fixed Vs Variable Annuity A Closer Look at Fixed Annuity Or Variable Annuity What Is the Best Retirement Option? Benefits of Immediate Fixed Annuity Vs Variable Annuity Why

More

Latest Posts